Tax Benefits of Qualified Charitable Distributions for 2025

Learn about the benefits of donating your Required Minimum Distribution (RMD) with a Qualified Charitable Distribution (QCD).

Disclaimer: The information provided on this blog is for general informational purposes only and is not intended as legal, financial, or professional advice. While we strive to provide accurate and up-to-date content, the information may not be applicable to your specific situation or jurisdiction. Always seek the advice of a qualified professional, such as an attorney, accountant, or financial advisor, before making any significant financial, legal, or business decisions. The use of this blog’s content does not create a professional relationship between the reader and the author.

What is Qualified Charitable Distribution?

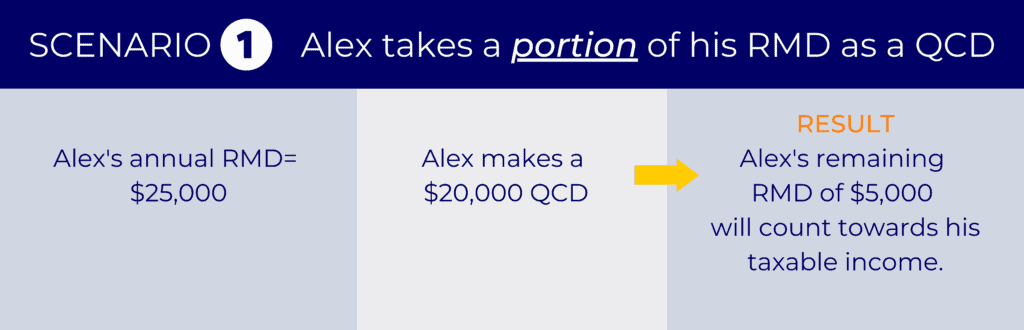

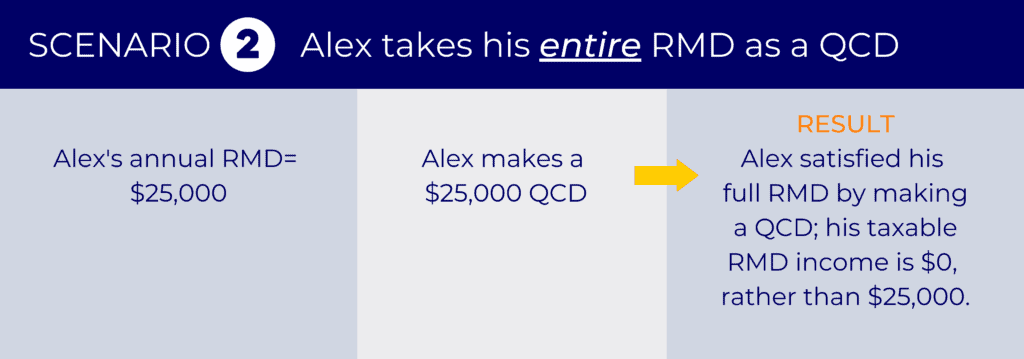

A Qualified Charitable Distribution (QCD) is a way to support your favorite charities directly from your IRA. When you make a QCD, you donate funds from your IRA to a qualified charity without incurring income taxes on the distribution. This can be an excellent strategy if you’re looking to satisfy all or part of your Required Minimum Distribution (RMD) without increasing your taxable income.

While a QCD doesn’t provide a charitable deduction, it does have a major tax advantage: you won’t owe taxes on the donated amount, making it a growingly popular choice for many donors.

To qualify, the distribution must go directly from your IRA administrator to the charity of your choice, like Bello Machre. Individuals aged 70½ or older can make QCDs up to $108,000 annually from their IRA. If both you and your spouse have separate IRAs, you can each make a QCD, potentially doubling the impact.

An IRA rollover, like a QCD, offers several tax advantages. By giving from pre-tax assets, you support causes you care about without affecting your tax bracket. This is especially valuable if you don’t itemize deductions or face limits on charitable deductions. By lowering your taxable income, an IRA rollover gift can help keep you within your current tax bracket and reduce potential tax burdens.

Qualified Charitable Distribution (QCD) Rules & Age

To qualify for a QCD:

- You must be at least 70½ years old.

- Donations can be directed to one or more qualified charities, specifically 501(c)(3) organizations eligible to receive tax-deductible contributions.

- Report the QCD on IRS Form 1040 or Form 1040-SR.

IRS QCD Limits 2025

For 2025, the maximum Qualified Charitable Distribution amount is $108,000.

What Charities Qualify for QCD?

Charities that are 501(c)(3) and eligible for tax to receive tax-deductible contributions.

Donate your Required Minimum Distribution (RMDs) to Charity

“We are blessed to have this opportunity to give back to Bello Machre,” say parents Chet and Elaine. They explain, “Our son is a resident at one of Bello Machre’s group homes and receives Community Development Services, as well. We wanted to find a way to support Bello Machre that made the most sense for us.” While exploring options, Chet and Elaine learned about the opportunity to donate their Required Minimum Distribution (RMD).

“Giving from an IRA has always been an effective way to reduce your taxable income. Withdrawals to satisfy your RMD are taxed as income at your income level, but if you use your distribution (or part of your distribution) to make a gift to Bello Machre, you will not pay the income tax associated with the charitable portion,” explains Development Director Tracy Lynott. “Donating to a qualified charitable organization can help you meet your RMD while making a positive impact on your community!”

What is a Required Minimum Distribution for IRA?

Required Minimum Distribution (RMD) is an amount of money that the IRS requires anyone 73 or older to withdraw from tax-deferred retirement accounts each year, including IRAs and 401(k) and 403(b) plans. RMDs are taxed as ordinary income, so each withdrawal counts toward a person’s total taxable income for the year.

What are the rules for Required Minimum Distribution?

Starting in 2023, the age for Required Minimum Distribution (RMD) was raised to 73 from the previous required age of 72. So, a person’s first RMD must be taken by April 1 of the year after turning 73. After that, RMDs must be taken by December 31 of each year. Otherwise, you will face a 25% penalty tax on the RMD amount not withdrawn.

Required Minimum Distribution to Charity

Many retirees choose to donate their Required Minimum Distribution (RMD) as a Qualified Charitable Distribution (QCD). While the IRS requires you to start withdrawing from your IRA at age 73, you can avoid paying taxes on the distribution by donating it directly to a charity you care about—this is known as an IRA charitable rollover.

Here’s how to set up your IRA charitable rollover:

- Contact your IRA administrator.

- Request that your RMD be sent directly to the nonprofit of your choice instead of to you personally.

- Provide the charity’s full name, tax ID, contact person, and mailing address to your administrator.

For Bello Machre, our mailing address is 7765 Freetown Road, Glen Burnie, MD 21060. Our primary contact is Tracy Lynott at tlynott@bellomachre.org or 443-702-3016.

Inform the charity that a donation is on the way to help streamline the process.

IRA RMD Table for 2025

An easy way to calculate the RMD that must be withdrawn is to consult the IRA’s RMD table.

Learn More About DONATING TO BELLO MACHRE

Benefits of Donating Your RMD to Charity

You can donate your Required Minimum Distribution (RMD) as a Qualified Charitable Distribution (QCD). By giving that money (up to $100,000) to a charity instead of taking it as income, you will not be taxed.

Explore IRA Qualified Charitable Distributions

If you have an IRA and are interested in setting up a QCD, be sure to talk to a tax professional, first.

Get Started at the Bello Machre Planned Gifts Page

Donating your Required Minimum Distribution is one of many ways to support charities like Bello Machre. You can learn more about ways to give to Bello Machre, plus read inspiring stories from our donors when you visit our Planned Gifts page.

“Giving back to Bello Machre is the greatest feeling,” Chet and Elaine conclude. “If you can donate your RMD, you won’t regret it.”

IRA Charitable Rollover Gifts make an important impact on the people we support at Bello Machre! If you are of age, please consider giving back in this beneficial and meaningful way.

Qualified Charitable Distribution & RMD FAQs

Learn More About Bello Machre’s Disability Services

Disclaimer: The information provided on this blog is for general informational purposes only and is not intended as legal, financial, or professional advice. While we strive to provide accurate and up-to-date content, the information may not be applicable to your specific situation or jurisdiction. Always seek the advice of a qualified professional, such as an attorney, accountant, or financial advisor, before making any significant financial, legal, or business decisions. The use of this blog’s content does not create a professional relationship between the reader and the author.